As interest rates begin to rise from historically low levels, the focus often turns to the potential negative impacts, such as increased borrowing costs. However, higher interest rates also bring positive opportunities, like the ability for investors to earn higher yields through money market accounts. Recent changes in Regulation D have made money market accounts even more appealing by lifting transaction limits and reducing minimum balance requirements in several banking institutions. Let’s delve into what money market accounts are, how they function, and address common queries to help you determine if this type of account aligns with your financial goals.

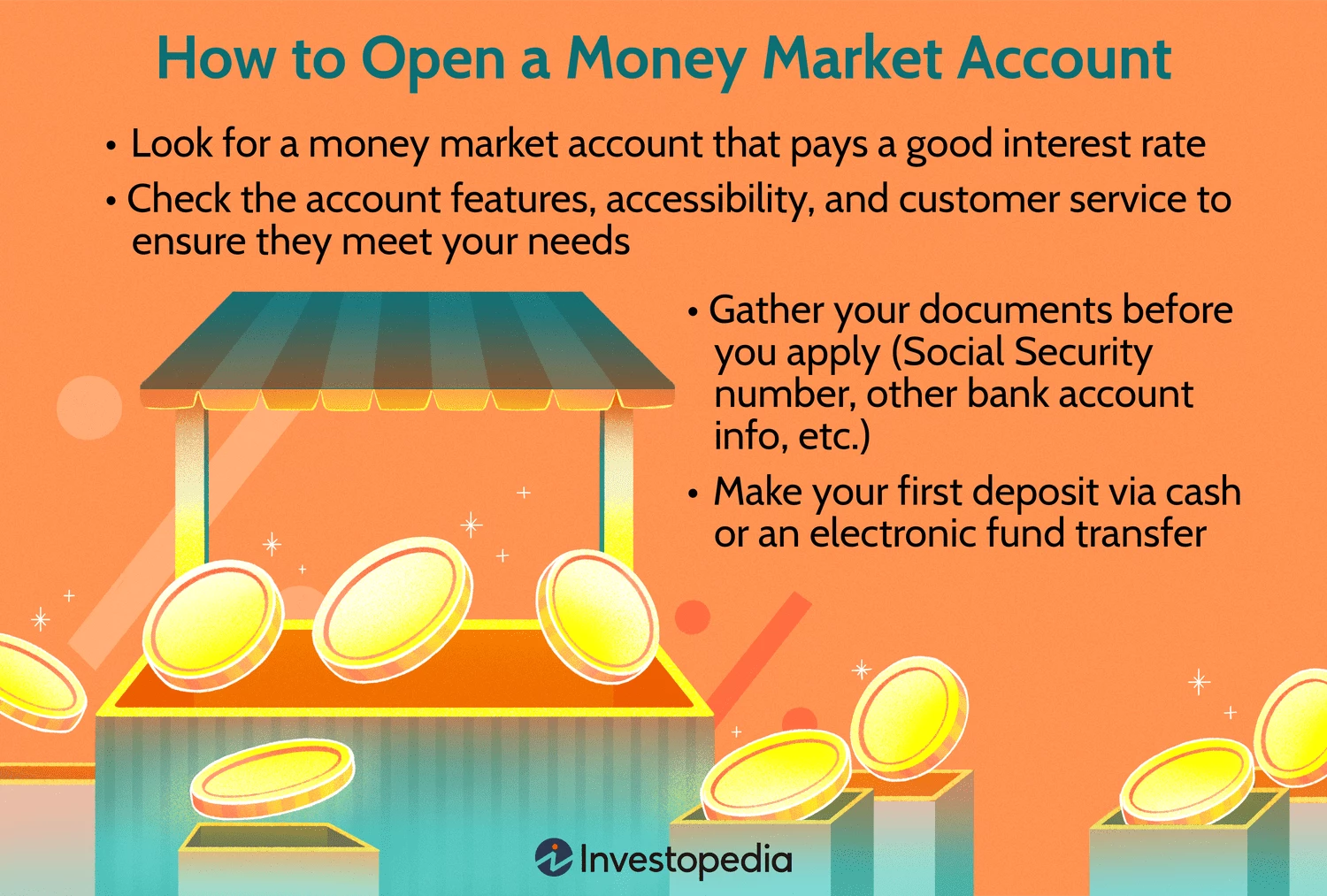

How to Open a Money Market Account

Money market accounts are readily available at most banks and credit unions. Here are the steps to open one:

Step 1: Choose a suitable money market account. Select an account that fits your needs based on features like interest rates, accessibility, and customer service. Ensure it offers essential features like debit card access, if needed.

Step 2: Prepare necessary documents. Have the required documentation to prove your identity ready when opening the account.

Step 3: Make your initial deposit. Depending on whether you open the account in person or online, you’ll need to fund your account through a cash deposit or electronic transfer.

Compare Providers

Provider | Best For | Key Benefit

— | — | —

Prime Alliance Bank | Best Overall | Competitive interest rate

Patelco Credit Union | Best for Small Balances | Higher APY for smaller balances

Axos Bank | Best for Debit Users | Full debit card access with no monthly fees

Ally Bank | Best for Ultimate Flexibility | Access funds online, via ATM, debit, or Zelle

Synchrony Bank | Best for IRA Options | Rollover existing IRA to an IRA money market account

What You Need to Open a Money Market Account

To open a money market account, you must complete an application with the banking institution. This process typically involves providing personal information like your full name, address, social security number, employment status, and more. You might also need optional details related to joint owners, beneficiaries, check issuance, or debit card requests.

Previously, money market accounts required significant minimum deposits. However, recent regulatory changes and increased competition have led many institutions to lower these requirements. Each bank sets its individual standards, so compare offerings before choosing.

Know The Basics

Money Market Accounts vs. Other Bank Accounts

Money market accounts, recognized as traditional deposit accounts by the FDIC, provide unique features compared to standard bank accounts.

High-Yield Savings Account

Offering higher interest rates than typical savings accounts, high-yield savings accounts may come with additional fees and delayed fund access.

Checking Account

Checking accounts, while usually interest-free, offer high liquidity for day-to-day transactions through checks, debit cards, or cash withdrawals.

Certificate of Deposit (CD)

CDs provide higher interest rates than savings accounts but require locking funds for a specified period, potentially incurring penalties for early withdrawals.

Factors to Consider When Opening a Money Market Account

Before opening a money market account, evaluate key factors to align the account with your financial objectives.

– Annual percentage yield (APY): Higher APY translates to increased earnings on deposited funds.

– Fees: Assess potential account fees related to transactions, even with recent regulatory changes.

– FDIC insurance: Money market accounts are FDIC-insured up to $250,000, safeguarding deposits.

– Transaction limits: Some institutions may maintain transaction limitations or charge fees beyond specific monthly transactions.

– Check-writing privileges: Verify if check writing is an available feature and aligns with your needs.

– Banking options: Ensure the account supports essential banking transactions and understand associated fees.

FAQs

What Is a Money Market Account?

Money market accounts blend features of savings and checking accounts, offering higher interest rates while providing check-writing and debit card functionalities. Recent regulatory changes have enhanced account flexibility by removing transaction limits, making them ideal for earning additional interest in a rising rate environment.

Money market accounts are FDIC-insured up to $250,000, ensuring deposit protection even during economic uncertainties.

What Are the Limits of a Money Market Account?

While money market accounts offer higher interest rates, account holders may face restrictions like limited monthly transactions, potential extra fees for additional transactions, and minimum balance requirements to maximize APY.

What Should You Use a Money Market Account for?

Money market accounts, now with reduced minimum balance requirements, are attractive for those seeking higher interest rates on savings. They can serve as an occasional savings account even if transaction limits persist, providing flexibility for various financial needs.

How Safe Are Money Market Accounts?

Money market accounts offer FDIC insurance up to $250,000 per account holder, ensuring account protection, particularly during financial uncertainties.

Are Money Market Accounts Taxed?

Earnings from money market accounts are taxable, requiring reporting on a 1099-INT for tax purposes. Consult a tax professional for personalized tax advice based on your financial situation.